Investors are optimistic about economic recovery, helped by global central bank and government measures

Published: June 4, 2020 at 4:38 p.m. ET, By Mark DeCambre and Andrea Riquier

The Dow Jones Industrial Average on Thursday booked a fourth straight gain, its longest run since late April, partly on the back of a burst higher in Boeing shares, but the broader market took a pause as investors found it difficult to push equity values demonstrably higher.

Overall sentiment over the past week has been boosted by efforts to restart the U.S. economy after business closures meant to combat the spread of the pandemic, and a report on weekly jobless claims did little to dissuade the bulls that equities have more room to run.

How did benchmarks perform?

The Dow Jones Industrial Average US:DJIA ended 11.93 points, or less than 0.1%, higher at 26,281.82, while the S&P 500 US:SPX fell 10.52 points, or 0.3%, to close at 3,112.35. The fourth gain matches a similar streak of wins for the blue-chip index ended April 27, according to FactSet data.

The Nasdaq Composite Index US:COMP finished 67.10 points, or 0.7%, lower to wrap up the session at 9,615.81, putting the index about 2.1% from its Feb. 19 all-time closing high, according to Dow Jones Market Data. Both the S&P 500 and the Nasdaq ended a win streak at four consecutive days with the session’s loss.

Meanwhile, the Nasdaq-100 index US:NDX closed off 75.02 points, or 0.8%, at 9,629.66 after carving out a fresh all-time intraday peak at 9,741.97, surpassing its Feb. 19 intraday level.

Read: The Nasdaq within 2% of a record high as the unbearable lightness of the stock market continues

What drove the market?

Although the S&P 500 index and the Nasdaq snapped a win streak, the underlying tendency of U.S. equity markets has been to drift higher.

While “it never feels comfortable” to see the stock market running ahead of the economy, said Randy Frederick, vice president of trading and derivatives at the Schwab Center for Financial Research, in an interview with MarketWatch, that’s always been how markets work. “Investing is an act of optimism. That’s what the market is telling us: things are going to get better.”

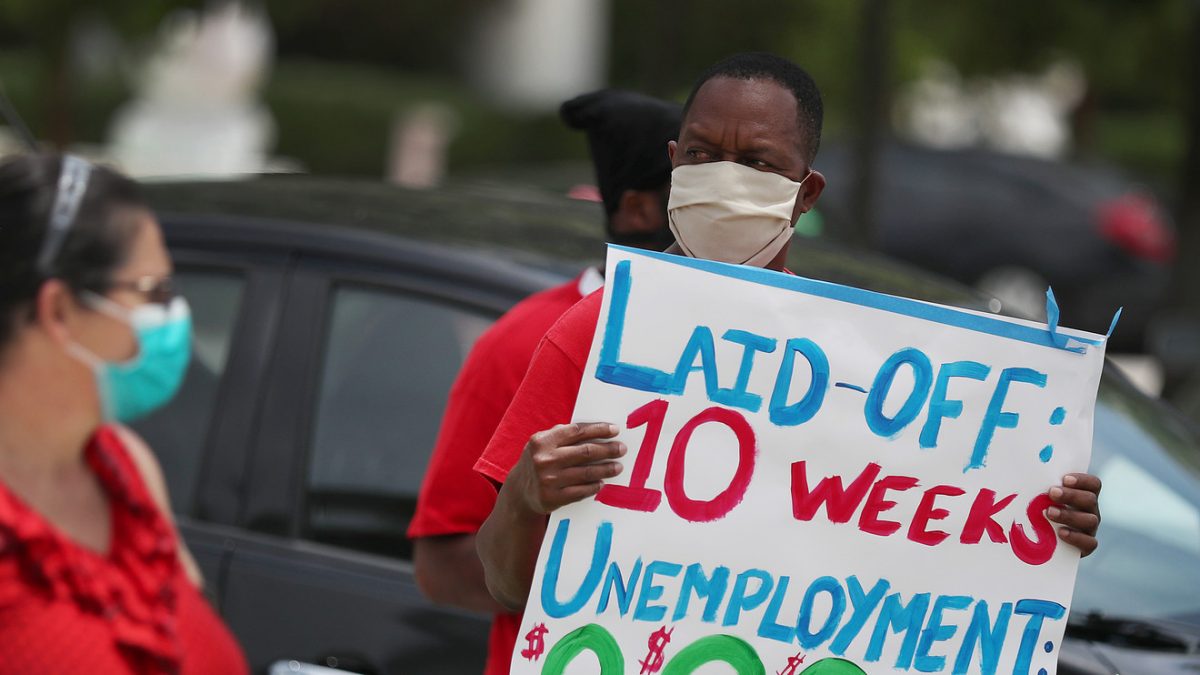

Another 1.9 million U.S. workers applied for first-time unemployment benefits in the week ended May 30, a bit higher than the 1.8 million consensus among economists polled by MarketWatch. While grim, the data suggest that the economy may have seen the worst of the impact of the epidemic.

Offering some words of caution was Mark Tepper, president and CEO of Strategic Wealth Partners, who called the rise in continuing claims, to 21.5 million, “worrisome because it means people remained unemployed and didn’t return to work.”

Private-sector employment data on Wednesday showed that a total of 2.76 million jobs were lost in May, Automatic Data Processing Inc. reported, but that loss also was far less severe than the 8.66 million forecast by Econoday. That report is often considered an early look at the Labor Department’s payrolls data, due Friday.

In a separate report, the Commerce Department said the trade gap widened nearly 17% in April.

Equity benchmarks in the U.S. have recovered from their March 23 lows, partly on the back of optimism surrounding the reopening efforts and evidence of a slower spread of the deadly infection as the summer gets under way, though some worry that recent a flare-up in infections could still occur.

Trillions of dollars in stimulus from the Federal Reserve and the U.S. government, underpinning financial markets, also have helped to drive the value of assets sharply higher from their March lows. The European Central Bank’s announcement’s on Thursday also may have reinforced that view.

Europe’s policy makers delivered further stimulus to its battered economy. Led by Christine Lagarde, the ECB said it would expand its Pandemic Emergency Purchase Program by €600 billion, or $674.5 billion. The central bank also said it would extend the program until June 2021, and reinvest maturing PEPP securities until at least the end of 2022. In a news conference, Lagarde said the economy was showing signs of bottoming out, but called activity still “tepid” and said she expects the bloc’s economy to contract 8.7% in 2020.

Those steps come as German Chancellor Angela Merkel’s coalition agreed on a €130B economic stimulus package to boost consumer spending and business investment, according to Bloomberg News. Germany, which has a history of fiscal prudence, last month backed an agreement, along with France, for an upsized €750 billion coronavirus European Union-wide recovery fund.

Thus far, U.S. civil unrest centered on the death of an unarmed black man at the hands of a white police officer in Minnesota hasn’t been reflected in stock-market trading, nor have rising tensions between China and the U.S., even as the Trump administration suspended flights to the U.S. by Chinese airlines in apparent retaliation for Beijing halting American flights bound for China.

Related: The stock market has been rising. Is that why Trump is attacking China?

Which stocks were in focus?

– Zoominfo Technologies Inc. US:ZI soared 62% to close at $34 a share on Thursday after pricing its initial public offering of 44.5 million shares at $21.

– Three Amazon.com Inc. US:AMZN warehouse employees sued the retail giant on Wednesday in New York, alleging working conditions put them and their families at risk of contracting the coronavirus. Shares ended off 0.7%.

– Michaels Cos. Inc. US:MIK shares rose nearly 9% after reporting same-store sales declines of 27%, badly missing analyst estimates. However, the retailer said it expected most of its stores to be open by the end of June.

– Ciena Corp. US:CIEN shares fell nearly 4.2%, despite earnings that blew away analyst forecasts.

– Navistar International Corp. US:NAV reported a narrower-than-expected loss, and beat analyst expectations on revenue. Shares ended the session 12.4% higher.

– Potbelly Corp. US:PBPB shares surged 25% in morning trade after the restaurant operator said same-store sales were improving.

– Genius Brands International Inc. US:GNUS shares resumed trading after a halt, then fell 13.5% after rocketing more than 2,400% over the past month.

– Shares of Boeing Co. US:BA closed 6.4% higher as more airlines resumed flying.

– Shares of American Airlines Group Inc. US:AAL soared more than 41%, notching a record gain Thursday, to lead a broad rally in the airline sector, after the carrier said it was boosting capacity amid increasing signs that the worst of the COVID-19-related crisis was over.

– U.S. listed shares of China-based Luckin Coffee Inc. US:LK surged 57% on Thursday, on no apparent news.

– Slack Technologies Inc. US:WORK tumbled 15% in after-hours action even after reporting better-than-expected results after the close of trade Thursday. The messaging company ended the regular session off 4.9%.

See: Europe’s stock-market rally is leaving the U.S. behind as ECB and governments step up, analysts say

How did other assets trade?

Oil prices edged higher Thursday amid uncertainties over a OPEC+ meeting, with West Texas Intermediate crude for July delivery US:CLN20 rising 12 cents, or 0.3%, to settle at $37.41 a barrel on the New York Mercantile Exchange, after touching an earlier low of $36.38.

In precious metals, August gold US:GCM20 on Comex tacked on $22.60, or 1.3%, to settle at $1,727.40 an ounce.

In global equities, the Stoxx Europe 600 index XX:SXXP closed 0.7% lower, while the FTSE 100 index UK:UKX ended down 0.6%.

In Asia, Japan’s Nikkei JP:NIK rose 0.4%, the China CSI 300 XX:000300 finished nearly unchanged for a second straight day and Hong Kong’s Hang Seng Index HK:HSI rose 0.2%. South Korea’s Kospi index KR:180721 gained 0.2%, following a 2.9% surge in the previous session.

The 10-year Treasury note yield BX:TMUBMUSD10Y lost 5.7 basis points to end at 0.818%, marking its highest level since March 25, according to Dow Jones Market Data. Bond prices move in the opposite direction of yields.

The greenback was 0.5% lower against its major rivals, according to the ICE U.S. Dollar index US:DXY.

See: Amid disease, riots and rising U.S.-China tensions, the stock market keeps it cool

Source: www.marketwatch.com