TECHNOLOGY stocks have become an essential part of the asset portfolio of many investors.

Amid the global push towards a digital way of life, many have started piling their money into semiconductor and tech-related stocks to take advantage of their growth prospects.

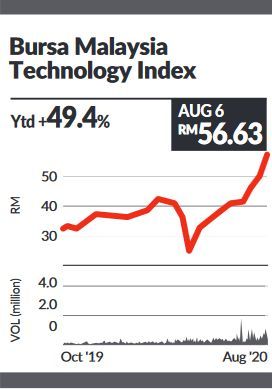

On Bursa Malaysia, technology is the next best-performing sector after healthcare in terms of year-to-date gains. The high trading volume in the sector is also an indication of growing investor interest in semiconductor and tech-related stocks.

No surprise, one analyst tells StarBizWeek, pointing to the inevitable evolution of information technology (IT) and the deployment of new technologies such as the fifth-generation (5G) mobile Internet connectivity as driving factors.

“If anything, this Covid-19 pandemic has accelerated the shift towards new technologies and automation. So, there are growing expectations of higher capital expenditure (capex) on IT during and post-Covid-19, ” the analyst, who is attached to a local brokerage, explains.

“For instance, we expect to see a rise in the demand for data centres and cloud services, and many companies will be looking at adopting better software solutions or new technologies to, among other things, improve productivity and cost-efficiency or simply to enable their employees to work from home, ” he adds.

The growth story of the tech sector, one broker notes, offers investors an alternative opportunity to gain in the current public health crisis.

“Healthcare-related stocks, particularly glovemakers, have registered significant increases in the current pandemic. Many are now trading at premium valuations, and some have become just too expensive for retail investors to jump on the bandwagon, ” the broker says, citing Top Glove Corp Bhd and Hartalega Holdings Bhd that are now trading above 100 times price-earnings (PE) as examples.

The tech sector, on the other hand, still offers some value, he says.

“Many are also trading at relatively more affordable prices (compared to glove stocks); and certain tech stocks do offer some upside potential, ” he adds.

Strong rally

In tandem with the strong rise of tech stocks on Wall Street, such as the so-called FAANG (Facebook, Apple, Amazon, Netflix, Google), local semiconductor and tech-related counters have also staged a visible V-shaped recovery in recent months.

The Bursa Malaysia Technology Index of 38 stocks has doubled from its March low to now trade at its 16-year highs. Year-to-date, the index has gained 49.4%, outperforming the FBM KLCI, which is trading at around the same level it did at the start of 2020.

Among the stocks that have driven the Bursa Malaysia Technology Index to its current levels are Notion VTEC Bhd, Mi Technovation Bhd, UWC Bhd and Prestariang Bhd. These are some of the stocks that have seen their share prices more than double since the start of the year.

Other star performers that have gained at least 50% since the beginning of this year are Frontken Corp Bhd, Unisem (M) Bhd and Vitrox Corp Bhd.

Demand growth

The demand growth for electronics equipment, particularly semiconductors, has picked up, and this is expected to benefit many local manufacturers.

Latest data from the US-based Semiconductor Industry Association show worldwide sales of semiconductors grew 5.1% to US$34.5bil in June from US$32.9bil a year ago, driven by demand from markets in the Americas and China. This represented the fifth consecutive month of growth on a year-on-year (y-o-y) basis.

In total, semiconductor sales had increased 6% y-o-y to US$208.1bil for the first six months of 2020.

According to the World Semiconductor Trade Statistics Organisation, global semiconductor sales is expected to grow 3.3% in 2020 amid the prevailing uncertainty posed by the lingering macroeconomic headwinds before accelerating to a growth of 6.2% next year.

Despite the growth projection, TA Research is maintaining its “neutral” stance on the semiconductor sector for the time being.

In its recent report, the research firm says its “buy” recommendation is on Unisem, with a target price of RM4.28, for the company’s strong near-term order visibility, robust earnings growth profile, and healthy balance sheet, with net cash of RM68.9mil, or 9.5sen per share.

Other tech stocks under its coverage are currently under review pending their upcoming results release, TA Research says. These include Malaysian Pacific Industries Bhd (MPI), Elsoft Research Bhd and Inari Amertron Bhd. Its previous recommendations on MPI was “buy”, with a target price of RM13.10; “hold” on Elsoft with a target price of 70 sen; and “sell” on Inari with a target price of RM1.48.

AmInvestment Bank Research, on the other hand, is more optimistic on the tech sector, having recently upgraded its outlook to “overweight” from “neutral”, citing attractive valuations with expected recovery in the second half of 2020.

“As the automotive and industrial segments have been hit harder by Covid-19, we expect the focus to be on the telecommunications segment with the 5G growth upswing; growth in smart sensors with applications in telecommunications and automotive segments; and the adoption of Industry 4.0 technologies such as Artificial Intelligence, Internet of Things and automation to rapidly increase production when economies recover, ” the brokerage says.

Source: The Star, August 8, 2020