Stifel’s Bannister says view favors ‘reflation’ trade, boosting cyclical sectors

Published: May 27, 2020 at 10:26 p.m. ET, By William Watts

The worst is past when it comes to the economic hit caused by the COVID-19 pandemic, clearing the way for the S&P 500 to continue its climb back toward its all-time high through the end of August, according to a Wall Street analyst who called for stocks to bounce back aggressively just ahead of the market’s March 23 lows.

“We now raise our S&P 500 price target to 3,250 by Aug. 30, 2020 (in 3 months), supported by economic survey data improving/bottoming (consumer, services, industrial) and our expectation that the S&P 500 [price/earnings ratio] expands (at prevailing low real bond yields) to offset weak [earnings per share] typical of late-stage recession periods,” wrote Barry Bannister, chief institutional equity strategist at Stifel, in a Wednesday note.

That would mark a 7% rise from the S&P 500’s close at 3,036.13 on Wednesday. Stocks jumped, with the large-cap benchmark advancing 44.36 points, or 1.5%. The Dow DJIA ended Wednesday with a gain of 553.16 points, or 2.2%, at 25,548.27, while the Nasdaq Composite Index COMP advanced 72.14 points, or 0.8%, finishing at 9,412.36.

The gains saw the S&P 500, which fell 34% from its all-time closing high on Feb. 19 to its March 23 low, finish just 10.3% away from its all-time high. The S&P 500 and Dow closed at their highest levels since early March, while the Nasdaq saw its highest close since Feb. 20.

Stocks traded at record highs in February, then tumbled into a bear market at breakneck speed as the COVID-19 pandemic resulted in the lockdown of the U.S. and economies around the world. Stocks set at least a near-term bottom on March 23, with the S&P 500 closing 33.9% below its Feb. 19 record high at 3,386.15.

Bannister previously acknowledged being initially “blindsided” by the pandemic but called on March 19 for a stock-market rebound that would see the S&P 500 SPX rally back to 2,750 by April 30. On April 18, as the index hit his mark, he raised that target to 2,950, but warned that gains beyond that level could be difficult to come by. On April 30 he left his target unchanged, arguing it would likely take another shock, inducing the Federal Reserve to step in with additional stimulus, to fuel another leg higher.

In his Wednesday note, Bannister said that after a month of roughly sideways action, the degree of monetary stimulus by the Federal Reserve and fiscal measures by the government have proven crucial to keeping the market supported, while the recent surge for stocks may signal a positive inflection for gross domestic product in the third quarter, which could boost earnings per share, or EPS, in 2021.

But the 3,250 target also reflects an expectation of a “normal” expansion of the P/E ratio that would offset the fall in EPS.

Although EPS typically declines for about 18 months around recessions, the price of the S&P 500 from the month that EPS peaks to the month that EPS bottoms is usually flat, he wrote, despite earnings falling an average 21%. “This occurs because the P/E ratio of the S&P 500 expands to offset weak EPS,” Bannister said.

And while Wall Street earnings estimates for the S&P 500 have fallen sharply, a fall in the real, or inflation-adjusted, 10-year Treasury yield since June of last year has supported the P/E ratio, he said.

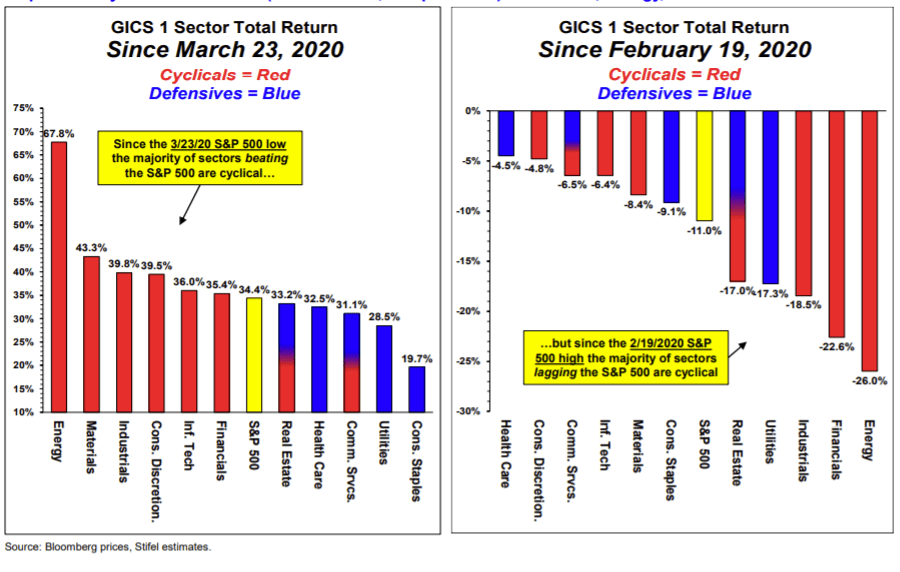

Bannister noted that, measured from the March 23 low, cyclical sectors are the top performers. But measured from the Feb. 19 high, cyclicals are the weakest (see chart above). “With room to run, our GDP optimism favors cyclicals, particularly a turn in reflation (weaker dollar, steeper curve): financials, energy, materials and industrials,” he said.

Source: www.marketwatch.com