Summary

- OXY has shown and executed a comprehensive plan to return the balance sheet and cash flow to normal.

- The risks posed by the balance sheet, macroeconomic outlook, and politics are overstated, creating a buying opportunity.

- Lastly, through the CO2 extraction project and JV’s, the company can outperform its peers and surprise investors.

Thesis Summary

Occidental Petroleum Corporation (OXY) has suffered the same fate as many energy companies, falling by over 70% in the last year. This has come as an unwanted shock for those already invested in the company. But for those looking from the outside, the current price is an incredible opportunity to invest in a business with a long history and proven track record of offering shareholder value. OXY is making the right moves to return to its prior glory. This beat down stock may still hold value after all.

Debt is not a problem

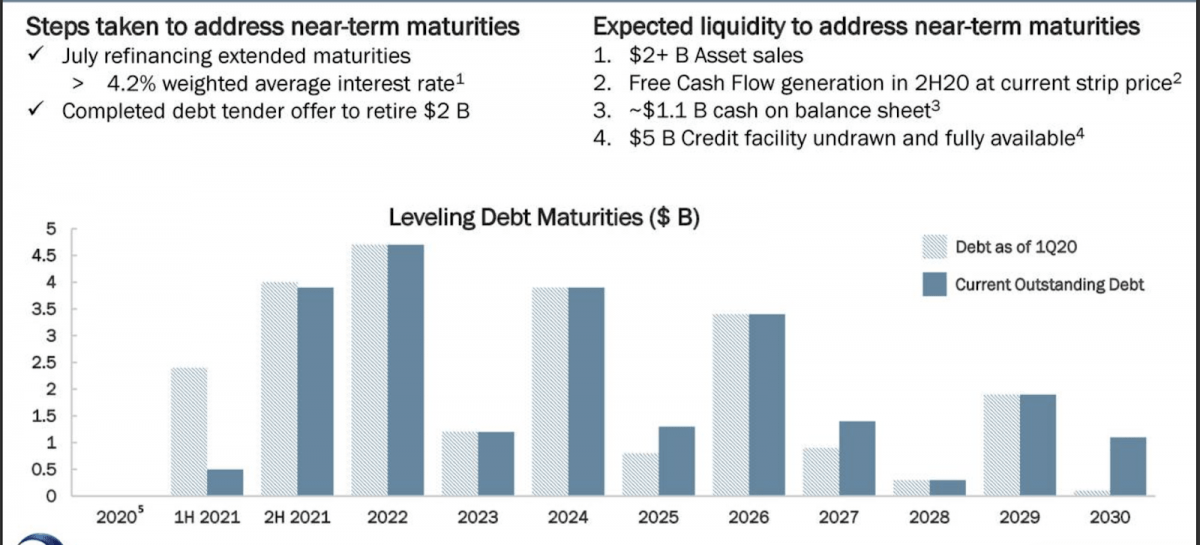

Any piece on OXY today must cover the issue of their debt burden. As of the latest quarterly report, OXY has around $9 billion in current liabilities and a whopping $36 billion in long-term debt. The following chart paints the picture quite well.

Above we can see OXY’s debt at the time of each maturity. In the next 3 years, the company will have to pay down over $9 billion in debt. The main way the company will achieve this is through asset sales and cash flow. The company recently sold some land to Orion Finance for $1.3 billion. On top of that, the company has raised over $2 billion in tender and note offerings. Finally, the company has around $1 billion in available cash and a credit facility of $5 billion.

There isn’t much OXY hasn’t done to reduce costs and pay down debt, (aside from lowering the CEO’s wages). The company even cut production, saving it an extra $2.9 billion annually. The next two years will surely mark a before and after. Assuming a WTI of around $40, we could expect OXY to manage to just abought break even. By some rough calculations, 2021 should yield around $6 billion in operating cash flow, which should be enough to cover the debt after taking into account cash expenses and changes in working capital. Further effort will likely have to be made to get through 2022, but once it does the company will be financially stronger and ready to grow.

The bottom line is, OXY is far from bankrupt or even illiquid, and even if it can’t quite cover its debt with operating cash flow and asset sales, it can still roll over some of the maturities.

Profitability should not be a problem

With the debt problems left behind, OXY will be able to once again focus on growth and profitability. This is exactly the plan that has been laid out by management. Pay down debt, reduce costs, restore dividends, and grow production.

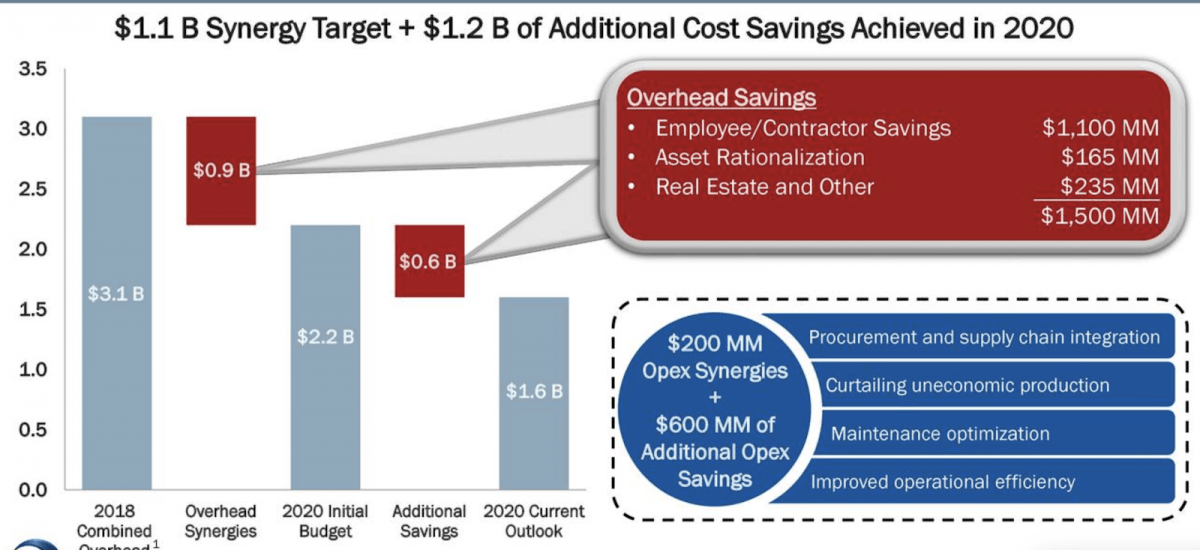

Starting with profitability, the company has already taken very big steps to increasing it. OXY was already one of the most efficient E&P’s in terms of extraction costs, turning a profit at over $30/barrel.

In the last year, OXY has already achieved over $2.3 billion in savings thanks to synergies and straight-up SG&A and marketing cuts.

But the most relevant and interesting development is OXY’s intent to use CO2 to cheapen its operations. Only a couple weeks ago, it was announced that OXY would be behind the largest CO2 removal plant in the U.S.; but why exactly?

This was covered briefly in the earnings call. Thanks to this new initiative, which of course comes with tax benefits, OXY can now obtain almost free CO2. This means that their EOR business (Enhanced Oil Recovery) can now operate at much lower costs and higher margins. According to their estimates, this could add a further 2 billion barrels to production.

This initiative is a win-win, helping OXY clean the environment, their name, and increase their margin.

Growth should not be a problem

Growth may still be a few years out, but the company already has a compelling plan to make this a reality. In the long term, OXY still holds an incredibly diversified portfolio of assets around the world. However, in the short term, the company expects to exploit joint ventures (JVs) to achieve growth while reducing risk and leverage. The most recent example of this is the JV in the Midland basin with Ecopetrol (NYSE:EC).

The JV enables Ecopetrol to book ~160 MMboe of proved undeveloped reserves at transaction closing and provides access to one of the most prolific resource plays in the world. The JV will progressively increase production until 2027, when production for Ecopetrol in the JV is estimated to reach circa 95 kboed.

Source: Prnewswire.com

On top of that, Ecopetrol has to pay OXY $750 million in cash and another $750 million in carried capital. This deal is a win-win and allows OXY to increase its cash flow without increasing the debt burden. In the next few years, we should see more deals of this nature come out. This is simply the final part of OXY’s comprehensive plan to return the balance sheet and cash flow to normal. It starts with divesting the non-core assets, and focusing on the core assets and expanding their use through JV’s.

Risks

The most significant risk faced by OXY at this point is the same which the whole energy sector faces. Most analysts would agree that the sector as a whole has put in a low, but just how fast or bumpy the recovery will be is unknown. Most estimates agree that we should see barrel prices hover around the $40 mark. Anything below that, which is the case as of writing this, would seriously hamper the above profitability and deleveraging agenda.

On top of that, some people also point to the election as a significant political risk. Supposedly, Joe Biden and the Democrats are promising to follow an antipollution agenda which could hamper production in the U.S. However, the Democrats seem to have done a 360 on the issue, with Biden’s recent announcement that “I am not banning fracking“. To this extent, political risk may have been overstated.

Takeaway

For those that were already invested in OXY, this is one of those tests that every investor has to go through at some point. Now is not the time to panic sell. I believe that OXY could easily be trading back at $70 by 2024. For those looking to get in, now may be a perfect time. An investment in OXY could very quickly yield triple-digit returns. When everyone is selling, it is time to buy. Recency bias has made people forget that, ultimately, OXY is a profitable and well-run company.

Source: seekingalpha.com