Summary

- Occidental Petroleum is not just an oil and gas company anymore.

- The company is leveraging decades of experience managing carbon dioxide into new business ventures with a capital-light approach taking joint venture partners that bring something to the table.

- We think Occidental can be bought at present levels by risk-tolerant investors for future growth and income.

Introduction

Anyone want to read another doom and gloom article on Occidental Petroleum (OXY)? I didn’t think so.

I’ve got good news, you’re not going to read one here. This article will have a very specific focus, so I am going to link another very positive article on OXY, as it covers all the oil and gas and financial business I am going to skip in this article.

I have written extensively on this company since mid-2019. I initially fell under the spell cast by the spectacular assets Occidental Petroleum acquired from Anadarko, along with the potential of the promised synergies and divestiture program for non-core assets. This allowed me to look past the monumental debt the company racked up in so doing. In a scenario where oil prices continued the upward trend they were exhibiting at the time of this deal, I would be a bit ebullient as I looked back on it.

Obviously, that scenario didn’t develop, and the business case for the acquisition looks pretty weak in light of today’s oil prices. I am being kind in that assessment, particularly as its former challenger for Anadarko, Chevron (CVX), changed the merger dynamic with a stock swap transaction with Noble Energy (NBL). Never underestimate the role of serendipity in financial outcomes!

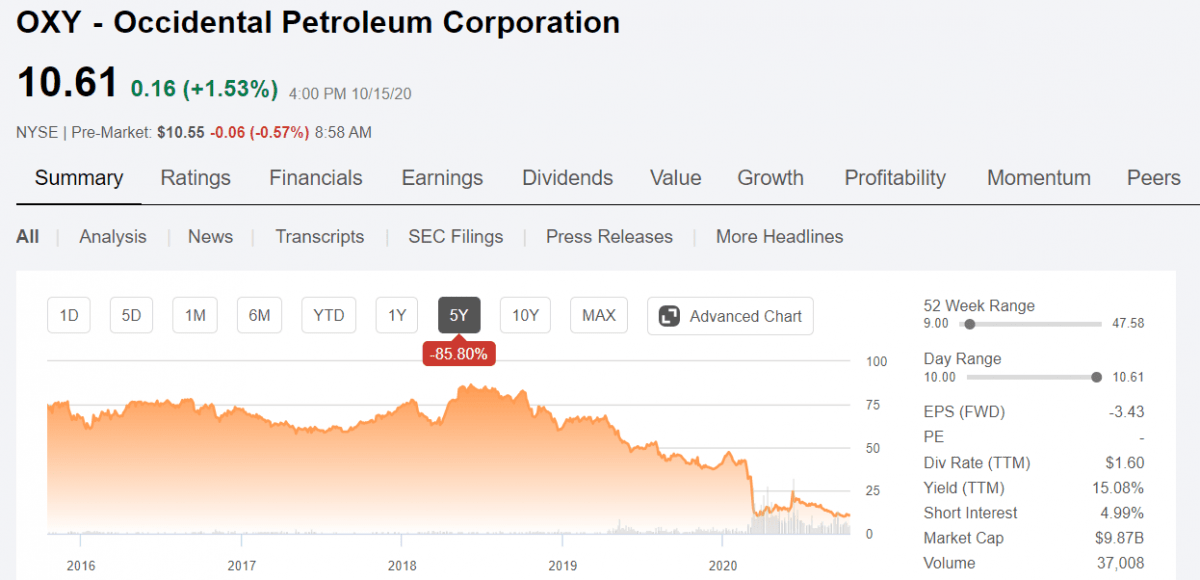

Today, with shares down as much as 80% from pre-merger levels, the formerly attractive dividend eviscerated, and concerns by some about OXY’s future as a going concern given their debt obligations, I’ve chosen to write about things that might go right for the company. I am a “glass is half-full” kind of guy.

Just for the record, I remain committed to the notion that the quality of assets that OXY picked up in the Anadarko deal will bear fruit in the not-too-distant future and give the stock a boost. My math has shale production declining to sub-6-mm BOEPD in 2021, about a third lower than its peak early this year. Combine that will a little continued restraint by the jolly lads in OPEC+ and a pick-up in the global economy, and WTI could revisit the $50s. Cost-cutting and restructuring to survive at ~$40 should create a wide lane for improved cash flow and margins. But we’re not there yet, so let’s talk about the OXY’s diversified future.

Last outing, we discussed the potential impact of the company’s GoM footprint. This time, we are going to discuss Oxy Low Carbon Ventures.

I’ll come right out and say it. OXY is a buy at current levels for investors willing to assume the lot of risk of dead money or even capital loss in a default scenario.

Risk and reward go together, so buckle up and listen to a thesis for growth in the carbon capture business.

The Carbon Capture and Utilization (CCUS) proposition

In order to achieve stated Paris Climate Accord goals of keeping this century’s temperature rise to less than 2 degrees C control and minimization of Green House Gas-GHG, emissions has been identified as a preferred pathway. Nearly all major oil corporations have signed on to this idea and incorporated it into their business plans. CO2 emissions are a principal target of the Paris accords.

One technology, CCUS, has been identified in a recent IEA report as being absolutely critical to implementing the objectives in the Paris accords. So, just what is CCUS?

Here is an excerpt from the IEA report:

(CCUS) is the only group of technologies that contributes both to reducing emissions in key sectors directly and to removing CO2 to balance emissions that are challenging to avoid – a critical part of “net” zero goals.

In a recent article on Baker Hughes (BKR), I highlighted this as an area of specific advantage for the company in the area of CO2 reinjection. OXY is traveling down a number of routes in support of Paris goals, and we will hit on some key areas that could bear fruit for the company in the next few years.

Oxy Low Carbon Ventures (OLCV)

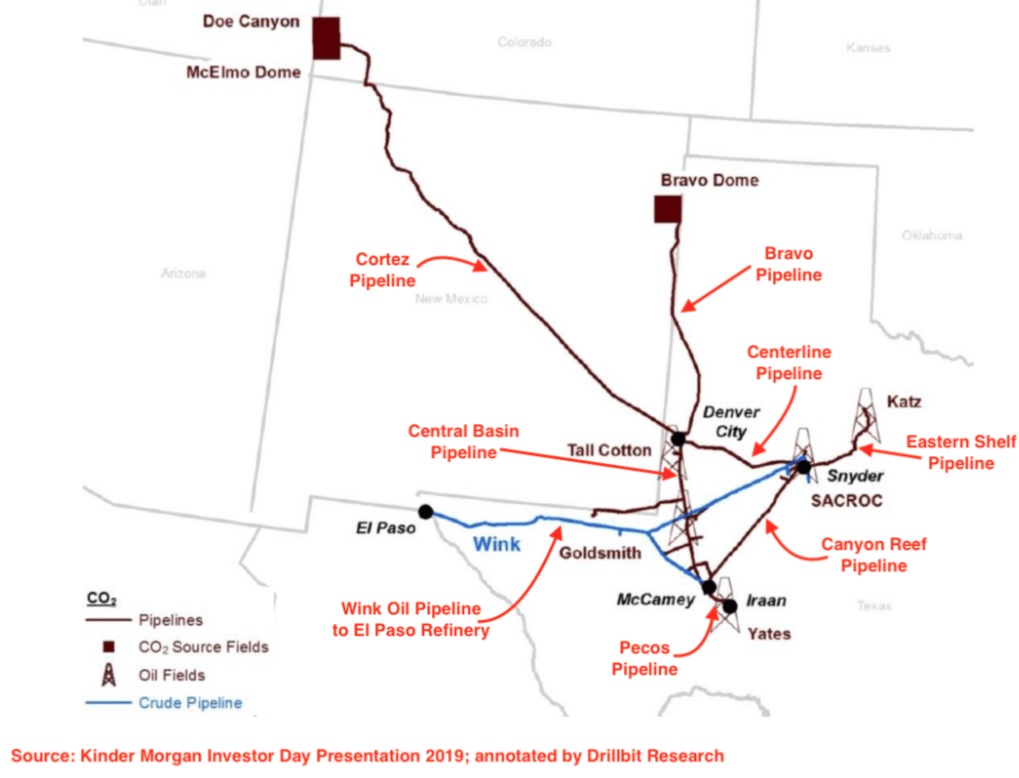

In one aspect, OXY has been capturing carbon dioxide for decades, injecting it into underperforming oil reservoirs to re-pressurize them and drive oil to the surface. For this period, OXY and other companies have actually been importing CO2 from several source points in Colorado to the formerly played-out ancient oilfields in West Texas. This referred to in the industry as Enhanced Oil Recovery (EOR), and is a significant contributor to OXY’s current production and earnings, and figures largely in its future plans.

That isn’t what we’re here today to discuss, other than to document OXY’s decades of prior experience managing CO2 and the fact that there is a huge internal catalyst to lower costs by reducing the import of CO2. This can be thought of as the “low-hanging fruit” of OLCV.

Vicki Hollub, OXY CEO, comments:

The reason we formed OLCV was that we needed a way to reduce our cost in our EOR operations. And even in our conventional EOR operations, the biggest driver or one of the two largest drivers of our costs there is CO2 and the cost that it takes electrically to inject our CO2. So electrical cost and CO2 are the two highest costs. We have about 2 billion barrels of resources available in the conventional that we can exploit. And when you take that and you expand it into the shale, that’s another probably 2 billion barrels that we can exploit in that as well. So the massive recovery that we can get just by lowering the cost of our CO2 is, in and of itself, a reason to continue our low carbon venture strategy in a very strong way.

(Source: Company Q2 2020 Earnings Call Transcript)

So, visualize something for which the company had previously piped from Colorado becoming essentially free of charge. Then, distribute that over a potential 4 billion barrels of recoverable crude from Permian EOR and Permian Resources, and you can see a massive cost advantage for OXY going forward.

That was then. Now Oxy Low Carbon Ventures is an umbrella banner under which a number of low-carbon initiatives will be pushed forward in the coming years. What is significant is that the company is leveraging its expertise in carbon injection and sequestration by forming partnerships and joint ventures to build these businesses from the ground up. It is not committing huge sums of internal capital away from its core oil and gas business to buy into offshore wind farms and other zero-advantage eco frippery, unlike some other companies I could name.

1PointFive

One of OXY’s key CCUS projects involves a JV with Carbon Engineering and Rusheen Capital Management and recently branded as 1PointFive. This JV using the specific skills, resources and technology of each will create a CO2 virtuous cycle.

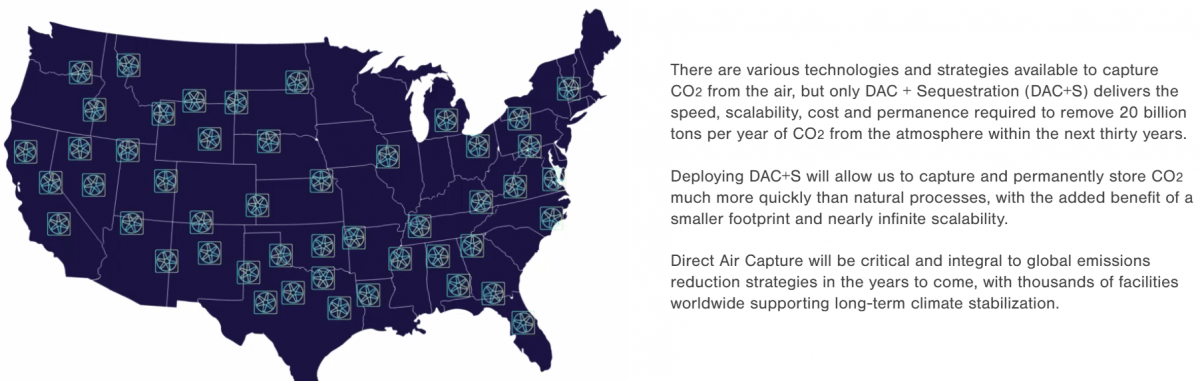

The formation of 1PointFive is a significant catalyst that will advance plans to build the world’s largest-scale DAC facility to remove substantial volumes of carbon dioxide emissions from the atmosphere. Here’s the idea.

The CO2 captured at the facility will be permanently, safely and securely stored deep underground in geological formations by Occidental. It will be used in lower-carbon oil production, which permanently stores CO2 as part of the process, and for geologic sequestration to deliver permanent carbon removal, a solution to counteract hard-to-eliminate emissions and help businesses achieve their net zero targets. With DAC, atmospheric CO2 can also be used as a feedstock to create low-carbon products like plastics and concrete.

Now, these are early days. With only one facility, the scalability of this technology remains to be seen. An idea of what the company thinks the future might hold is suggested by the graphic below.

NET Power

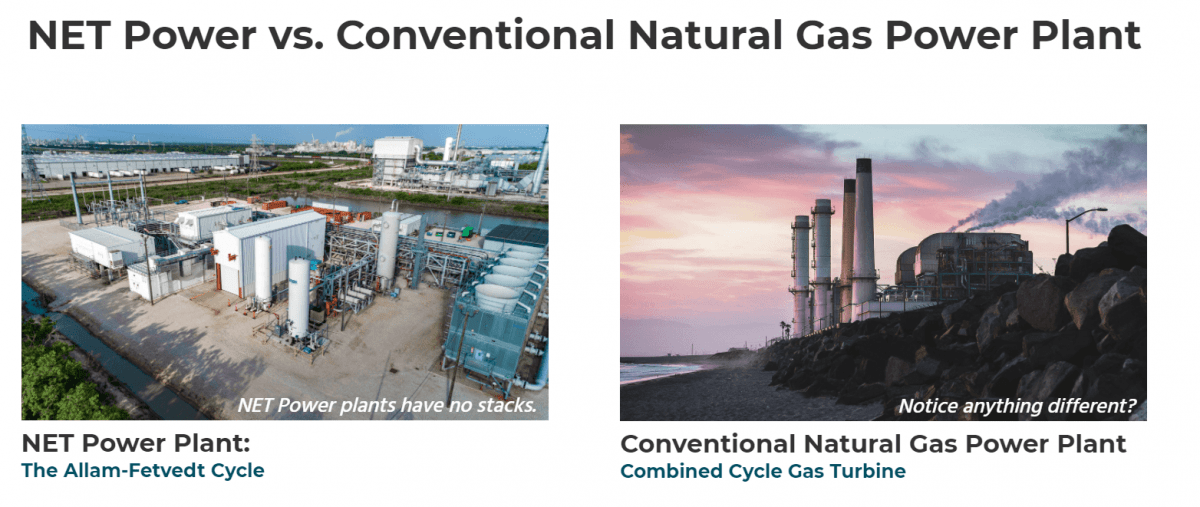

OXY is participating in the world’s first natural gas electricity demonstration plant that emits nothing to the atmosphere. The company’s CO2 capture IP base is again advantaged in conjunction with the resources of NET Power. In addition to removing CO2 from the atmosphere, a salable product is produced that can then be sold to other industries.

OLCV Services

OXY is also beginning to market this expertise in the form of carbon capture-related consulting and assessment modeling:

- Rapid Assessment Modeling helps new entrants to the carbon capture business assess their needs and see if their application makes sense in the current regulatory and technical framework.

- Carbon Sequestration services provide a dual pathway for revenue generation. One is permanently sequester captured CO2 through the Permian Basin Carbon Neutral Production operations to lower a client organization’s carbon impact. This reduces carbon emissions, while simultaneously contributing to the production of carbon-neutral fuels. Second, dedicated sequestration. With this form of sequestration, OLCV can engineer and develop dedicated CO2 sequestration wells to inject captured CO2 – permanently storing emissions underground and lowering the carbon intensity of a client’s production.

- Carbon Tracking and Retirement. OXY has developed two EPA-approved carbon monitoring, reporting, and verification (MRV) that is rolling out to potential clients. Here again, the legwork that the company has done over past decades in this area can provide future streams of revenue.

Your takeaway

None of this yet makes a financial impact that OXY so desperately needs or alleviates the direness of its financial situation. This is a story about the future. Not so different from the ones like BP plc (BP) and Shell (RDS.A, RDS.B) are telling us as they throw billions of dollars of capital around to buy their way into green energy initiatives as their petroleum businesses hemorrhage red ink from neglect and capital diversion.

What is different with the story OXY tells us is that the company is leveraging its CO2 expertise through joint ventures that could one day be accretive. It’s not so hard to imagine its future success here given the framework that exists for CCUS ventures today.

And, of course, there is ever-present government largess available to further these technologies. CEO Vicki Hollub comments on one aspect of this revenue potential from government sources:

Low Carbon Fuel Standard in California and with 45Q that was passed just a few years ago, we’re now able to provide revenue from this business model that we’re creating. So it turns into a very safe, low-risk steady stream of revenue for investors. And so this checks three boxes for us and it’s so critically important that we view this to be one day we’ll certainly generate, we believe, significant cash flow for our company as well.

(Source: Company Q2 2020 Earnings Call Transcript)

A check of the link to the California standard reveals exactly what Hollub is discussing:

The protocol allows transportation fuels whose lifecycle emissions have been reduced through CCS to become eligible for credits under the LCFS. Currently, the credits are trading at roughly $180 per ton, and can be combined with the federal tax credit for CCS projects. Also known as 45Q, the federal tax credit provides $50/t for CO2 stored geologically, and $35/t for CO2 stored permanently via enhanced oil recovery. “In the medium term, the establishment of a CCS protocol also paves the way for CCS to become eligible in the state’s Cap-and-Trade Program.

(Source: Global CCS Institute)

When you put this in the same hopper as other California regulations – SB-100 that requires 100% carbon free electricity generation by 2045, and B-55-18 that requires the entire economy to achieve carbon neutrality by the same year – you can see a tremendous legislative push toward OXY’s various forms of CCUS technologies.

What is the true size of the market? I don’t know of any firm amounts, but one estimate shows an annual capital requirement of $3.6 trillion is needed to meet Paris goals. That is probably a greater pool of funds than every oil and gas investment being considered today on the entire planet.

In summary, I think OXY is ahead of the curve in its OLCV initiative. The regulatory framework is largely in place and expanding outward from California and the U.S. I am impressed with the progress and the approach made thus far, leveraging expertise and minimizing capital exposure. And I think it has the potential to pay dividends down the road to long-suffering OXY investors.

Feel better now?