Summary

- The cruise lines continue to struggle to restart operations.

- The market has been as bullish on the cruise lines as the airlines despite airline passenger traffic up to 35% of 2019 levels.

- Carnival stands to burn another $3 billion in cash, if cruises don’t restart meaningfully until the Spring.

Since the cruise lines were forced to start shutting down back in April, the market has seemed to want to invest in the shutdown sector while ignoring the operating airline sector. The latest bullish analyst call has investors piling back into Carnival Corp. (CCL), yet the sector remains un-investable. My investment thesis remains Neutral on the stock until more progress is made on returning to cruising regardless of the virus.

CDC No Sail Order

The biggest impediment to the cruise line stocks is the ongoing CDC No Sail Order. Back in July, the government health organization extended a no sail order until September 30. At the time of the FQ2 earnings call, Carnival made it clear the CDC hadn’t engaged in serious discussions towards working out a health solution to allow for sailing at a future date.

The problem here is the health organization is unlikely to approve sailing in Q4 heading into the Winter months after pushing sailing out of the prime Summer months. An agreement appears rather unlikely, especially without a well dispersed vaccine, and the Cruise Lines Association has already agreed to not sailing through October.

Some of the cruise lines created a “Healthy Sail Panel” with 74 recommendations for returning to healthy cruising. Naturally, the panel recommendations include plans for tests, masks and temperature checks, but the plans come after six months of a cruise pause and could take a while to obtain CDC approval and implement.

Even the bullish Barclays call thinks the CDC is likely to extend the no sail date into Q4:

While chances are high (in our view) that the CDC extends the date again (likely into 4Q20), we believe the comments from the agency will be positive and could signal a near-term return to cruise.

My view all along was these cruise line stocks weren’t investable because the risk exists of pushing future sail dates into the March/April time period. The rising COVID-19 case count in Europe is likely to reduce the willingness of the CDC to approve solutions where the safer play is to just extend delays.

Not Even Bullish

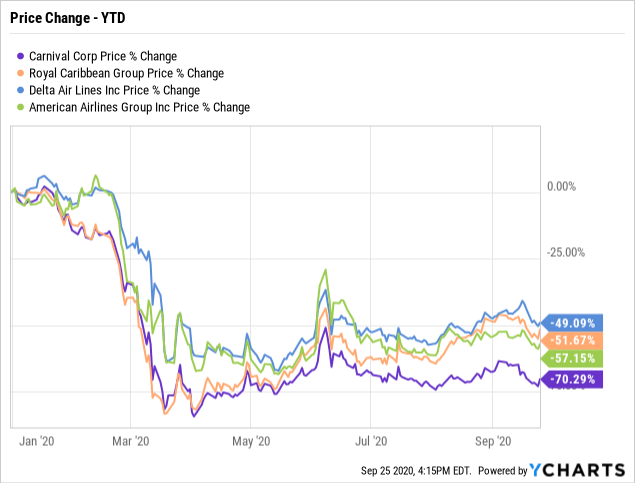

Barclays wasn’t even bullish on Carnival like the other cruise lines such as Royal Caribbean (RCL). Another reason to not be bullish on the cruise line stocks is that the airline stocks such as Delta Air Lines (DAL) and American Airlines Group (AAL) are down similar amounts YTD despite reaching 35% of the 2019 traffic on September 27, per the TSA.

The airline stocks don’t need government regulation changes to operate other than the removal of 14-day quarantines in New York and Hawaii. These stocks appear far closer to cash flow breakeven levels than the cruise lines that can’t even return to business outside of a few regions in Europe.

Carnival has the largest losses in the sector due to massive scale that won’t be an advantage in an environment that requires more nimbleness. The company last estimated a $650 million monthly cash burn rate for 2H of the year.

The cruise line stocks continue to hold far above 2020 lows due to apparent strong demand for out year bookings, yet Carnival will continue burning millions in cash on a daily basis until the CDC and other health organizations allow full cruises. Regent Seven Seas Cruises, owned by Norwegian Cruise Line Holdings (NCLH), set an opening day booking record for the 2023 World Cruise to inspire investors to buy the stock.

The problem here is the financial condition of the cruise line by the time these bookings are actually delivered. Carnival, Royal Caribbean and Norwegian still have to survive the frigid Winter months before embarking on the strong bookings for 2021 and beyond.

Carnival has the monthly cash flow burn rate down to $530 million FQ4. Absent any adjustment to the burn rate reinforced in September via the FQ3 earnings report, the cruise line stands to burn up to $3.2 billion in cash over the next 6 months (including Sept.) until the cruise market potentially unthaws in April when the typical flu season burns out.

Takeaway

The key investor takeaway is that one can bet on the CDC and other health organizations approving cruises, but the scenario appears highly unlikely considering the colder weather ahead.

The best bet is to stay on the sidelines until the sector has successfully completed cruises without any new outbreaks.

The sector has months, if not years, to return to normal from that point offering plenty of time to buy sector stocks on dips without the risk of very negative outcomes, if sailing is delayed beyond Spring 2021.

Source: SeekingAlpha, 28 Sep 2020